CHAPEL HILL, N.C. – Blue Cross and Blue Shield of North Carolina (BCBSNC), the only insurer in the state that has applied to serve all 100 North Carolina counties on the Affordable Care Act’s (ACA) health insurance Exchange, today announced pricing information for its ACA-compatible products for individuals.

Consumers can visit bcbsnc.com/bluemap for a summary of how the ACA might impact them, including whether they might qualify for a subsidy. Blue Map will be available online until Sept. 15. Consumers can also speak directly to BCBSNC representatives at one of many ACA informational events being held across the state. Click here for a list of these events.

“Health reform is complicated, and it affects everyone differently. We want to help North Carolina consumers understand how they will be affected and provide information to support them in making the best decision for their personal situation,” said Barbara Morales Burke, BCBSNC vice president of health policy and chief compliance officer.

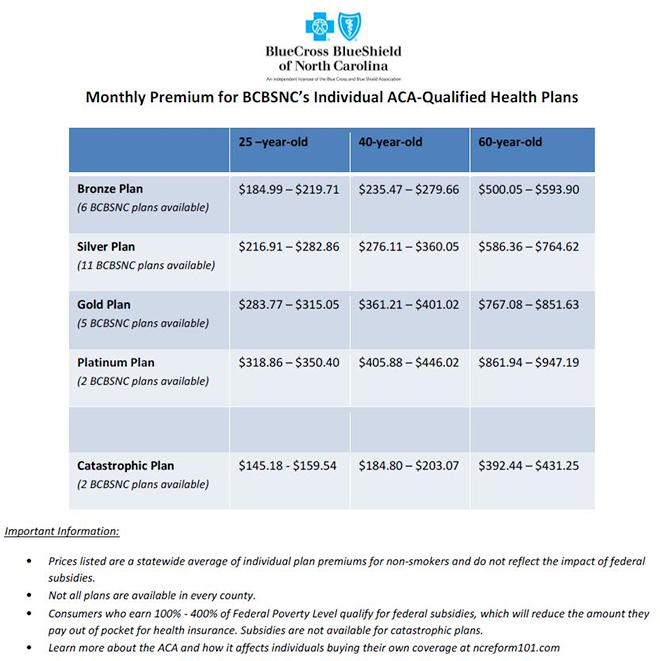

BCBSNC plans to offer 26 plans on the Exchange, including plans at every metal level and catastrophic option(s) for those who qualify. Catastrophic plans have higher deductibles and will be available for consumers under age 30 and those who receive “hardship exemptions1”. Bronze plans cover 60 percent of health care expenses, silver plans 70 percent, gold 80 percent and platinum 90 percent.

Statewide average rates for those plans are listed below:

Consumers can purchase the same BCBSNC ACA health plans, and access subsidies, from the Exchange or directly from BCBSNC. BCBSNC’s buy online tool facilitates the transaction for those who qualify for a federal subsidy (consumers purchasing their own coverage with income levels between 100 percent and 400 percent of Federal Poverty Level2). The subsidy impact will be significant for some. For example, a person earning 100 percent of FPL could pay $19.15 per month for a Silver plan.

By choosing to offer its products on the Exchange in all 100 counties, BCBSNC is ensuring that low- and middle-income consumers who depend on a subsidy to afford insurance will be able to access the subsidy and purchase coverage.

ACA health plans generally offer richer benefits than plans many BCBSNC customers choose today. In addition to requiring richer benefits, the ACA eliminates the use of gender or health status in setting premiums. Consumers may begin shopping for coverage – and can learn exactly how much subsidy they might receive – by visiting the Exchange when it opens.

“The ACA will make coverage available to many who have never had it and will enhance benefits for most consumers. These are good things, but they come at a cost,” said Patrick Getzen, BCBSNC vice president and chief actuary. “After the impact of subsidies, we expect about two-thirds of our individual customers will see the amount they pay for coverage increase similar to previous years – or they may pay less. The remaining one-third of our customers will see fairly substantial increases due to the requirements of the ACA.”

For comprehensive information about health reform, visit nchealthreform.com.

About BCBSNC:

Blue Cross and Blue Shield of North Carolina is a leader in delivering innovative health care products, services and information to more than 3.74 million members, including approximately 1 million served on behalf of other Blue Plans. For generations, the company has served its customers by offering health insurance at a competitive price and has served the people of North Carolina through support of community organizations, programs and events that promote good health. Blue Cross and Blue Shield of North Carolina was recognized as one of the World’s Most Ethical Companies by Ethisphere Institute in 2012 and 2013. Blue Cross and Blue Shield of North Carolina is an independent licensee of the Blue Cross and Blue Shield Association. Visit BCBSNC online at bcbsnc.com. All other marks are the property of their respective owners.

1 To qualify for a catastrophic plan, consumers must be under 30 years old OR get a "hardship exemption" because the Exchange determined that they are unable to afford health coverage.

2 In 2013, the Federal Poverty Level is defined as income of $11,490 annually for an individual or $23,550 annually for a family of four.

###

NC

NC